OpenShot Video Editor 3.1.1 Crack Plus Keygen Free Download

OpenShot Video Editor 3.1.1 Crack is a Chrome that allows creating and editing videos online. It is an integration with OpenShot instance, a free and open source video editor. It supports commonly used video codecs supported by FFmpeg such as WebM (VP9), AVCHD (libx264), HEVC (libx265) and audio codecs such as mp3 (libmp3lame) and aac (libfaac). The program can output MPEG4, ogv, Blu-ray and DVD video, and Full HD videos for uploading to Internet video websites. It is a video editor that integrates with our file manager to manage only video file types with this desktop app.

OpenShot Video Editor 3.1.1 Full Crack Free Download

Other areas have seen growth as well, yet have had less opportunities than others for doing so. DriverEasy was created for users with minimal computer knowledge who want to easily update drivers online – without errors like improperly configured machines; outdated versions installed are different than intended or latest; etc. Driver Easy is an online driver update software package created to optimize computer performance for faster, smoother operations with Windows OS computers. Driver Easy has long been trusted by technicians and installers as an essential way of gaining customers, and continues to do so today with over 8 Million database records being updated daily and over 3 Million registered users globally! When selecting Driver Easy as your partner in customer acquisition you gain peace of mind knowing you will always experience exceptional support service when needed.

OpenShot Video Editor Crack Free Full Activated

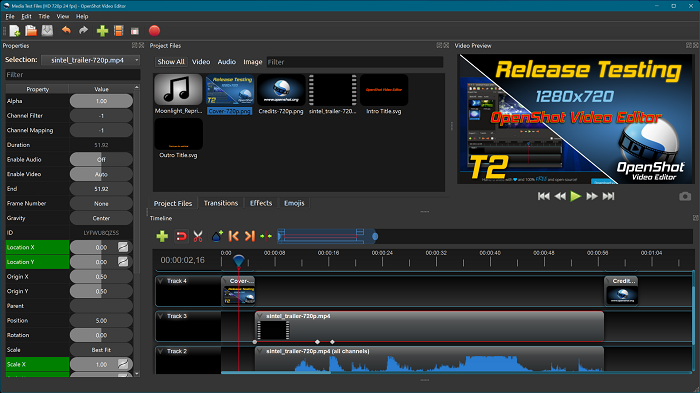

On your timeline, clips can be adjusted in numerous ways to tailor them perfectly – scaling, trimming, rotation, alpha channel adjustments and changing their location can all be adjusted easily with just a click or two! Our transform tool also makes interactive resizing of clips possible! OpenShot comes equipped with more than 400 transitions that enable a gradual fade-in between clips. Quickness and sharpness of transitions may also be adjusted with keyframes if necessary; overlaying two clips will automatically generate new transitions.

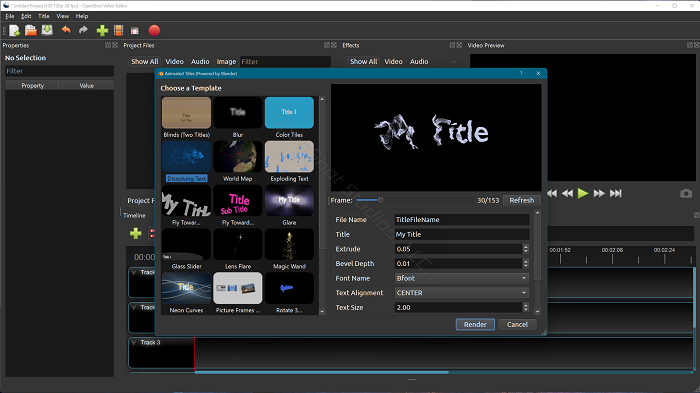

OpenShot includes over 40 vector title templates to make adding titles to your project easy and enjoyable. Alternatively, create SVG vector titles yourself and use these as templates instead. Our built-in title editor makes quick work of changing font size, color or text of titles quickly.OpenShot allows users to create stunning 3D animations powered by Blender’s wonderful, open source application. OpenShot comes preloaded with over 20 animations for use and allows customization of colors, sizes, length, text as well as many render properties like reflectivity bevel extrusion etc.

Features

- All elements from other tracks will automatically link back to the main video.

- Your materials will move together when you drag the main video player.

- Tracking accurate time can save time in reaching specific destinations more quickly.

- Large Driver Database of over 8,000,000!

- Keep Existing Drivers Up-to-Date, Address Driver Issues

- Safety Offline Scana – create driver analysis files without an Internet connection!

- Backup & Uninstall Drivers for Removed Hardware

- Driver Backup: Make an archive file containing your drivers for safe keeping and restoration at a later date.

- Customer Technical Support – to offer our customers assistance for driver related problems.

Pros

Edit videos in an easy, no-hassle fashion by simply dragging and dropping, with animations, watermarks, sound effects and many other exciting elements easily added into them. I have used Openshot video editor for three years and always found its features helpful and full of excitement – trim videos to your desired length while adding 3D animations of flying text or 3D effects as needed; speed up or slow down videos according to need; as the interface is very user friendly anyone can utilize this software without issue!

Cons

In the latest update, OpenShot 3.1.1 enables hardware acceleration in video editing, rendering and exporting processes. But it is still experimental support in this version. GPU acceleration depends on input and export formats. Hardware acceleration can only be activated when you edit MP4/H.264 videos.

OpenShot Video Editor License Key

- DSBSDR-YRGBC-RUYGFNE-RYFUNC

- DBBBDR-RUHBET-UGYHNC-RFYRHU

- QEWRF-ESFG-QETRSG-RWYSHFXGBV

- WRYSFG-RWYSFH-WRSHFD-5WUTEDGH

OpenShot Video Editor Activation Key

- HBEJGR-RYGFN-TYUVBE-YRGFHJ

- VBNEYE-YGNUTT-HGJRIV-RGHIRR

- WERYF-RSYFH-SRYHFV-SRHDVB

- ARSGFV-SRYFHV-SRYHF-SRYHFD

OpenShot Video Editor Registration Key

- HCO52-F1XT9-D4X3N-7GCQ3-HV510

- GZ41H-8DRNO-7GXRN-DY5MX-NRX3K

- NKZT0-PG4VP-EJVYX-7D3GL-GCORC

- DTSXW-5XZNR-gXDB7-JC6VI-HFX1H

OpenShot Video Editor Free Download 2023

- DSBSDR-YRGBC-RUYGFNE-RYFUNC

- DBBBDR-RUHBET-UGYHNC-RFYRHU

- QEWRF-ESFG-QETRSG-RWYSHFXGBV

- WRYSFG-RWYSFH-WRSHFD-5WUTEDGH

System Requirements

- An ideal operating system for Windows, Mac and Linux systems would be one featuring 64-bit technology.

- Multi-core processor that supports 64-bit systems

- 4GB is recommended; 16GB should provide more storage capacity.

- 500MB is necessary to install this program successfully on hard disk space.

- Solid State Drive (SSD) can also prove very valuable if you employ disk caching and an extra storage volume for disk-caching services.

- Hard disk spaces up to 10GB may be necessary; this choice, however, is entirely up to you.

How To Install?

- Download the Windows installer from our official download page.

- Open the Installer by double click on it. Follow the directions displayed on screen until completed.

- OpenShot will then appear in your Start menu!